These regulations may vary across regions and industries, so it’s vital to research and grasp the specific requirements applicable to your organisation. Companies can build stakeholder trust and https://api.langara-app.ca/screenshot_20190723-220602/ free up time for more strategic tasks by taking proactive measures to address statutory reporting problems. DATA AND TECHNOLOGYAll finance transformations are essentially challenges to convention. If the organizational data is handled properly, for instance, it can be integrated and harmonized in a way that serves the entire enterprise, across platforms—e.g., ERPs or other third-party systems—and is available for further analysis. Statutory reports include important non-financial information showing a company’s commitment to responsible business.

Every company can face a unique set of challenges when it comes to statutory reporting. PwC’s community of solvers come together in unexpected ways to help drive the tech-powered transformation you need. We can meet you where you are on the statutory reporting journey, work to understand your specific pain points and build a technology implementation roadmap that helps to solve them at your pace. PwC can help you maximize the use of Workiva’s cloud-based, collaboration platform by bringing together statutory reporting, technology and data professionals. Statutory reporting is the act of reporting financial information to regulatory bodies. For example, mandatory financial reporting to the Securities and Exchange Commission (SEC) counts as statutory reporting.

We prioritize flexibility and scalability through the use of our extensive accounting and financial reporting experience, leading practices, and proprietary tools. Our deep knowledge in local accounting, reporting, and risk management can help you transform global statutory reporting your statutory reporting functions. Whether you’re looking to redesign your operating model, automate the production of financial statements, or outsource your reporting, we can help you find new efficiencies, reduce risk, and integrate more standardization. Finally, the prepared reports must be submitted to the appropriate government agencies or regulatory bodies within specified deadlines.

Take a look into specific topics and steps companies can take now to simplify, standardize, and automate global statutory reporting (GSR) processes. With this knowledge, organizations can learn how to streamline their regulatory frameworks and move toward a more centralized and efficient compliance strategy. Statutory reporting refers to the financial reporting requirements carried out by all publicly trading companies, every quarter that must be complied with in order to maintain listing on the world’s stock exchanges. Failure to comply with statutory reporting requirements can lead of delisting from public stock exchanges and severe penalties.

Valuable time is often wasted manually checking that every corporate financial report is correct, is submitted on time and meets the local statutory reporting compliance requirements. The information reported through statutory reporting can vary depending on the jurisdiction, industry, and type of organization. These reports provide valuable insights into an organization’s financial health, environmental impact, workforce management practices, and adherence to legal and regulatory requirements. Global statutory reporting practices require companies to follow laws and regulations in each country where they operate.

The use of automated reporting software solutions is critical in this regard, given how it can reduce the risk of manual errors and ensure uniform standards despite a wide range of sources. Automation can streamline operations and ensure data hygiene is protected even when dealing with large amounts of it. Moreover, neglecting statutory reporting compromises an organization’s credibility and trustworthiness. Lenders and investors view adherence to statutory reporting obligations as a key indicator of an organization’s governance and transparency practices. Companies that disregard these requirements are often perceived as higher risk and less trustworthy, making it challenging to obtain loans, investments, and favorable credit terms.

Overlooking statutory reporting requirements can lead organisations down a perilous path, fraught with legal entanglements, reputational setbacks, operational hurdles, and financial distress. For large firms, statutory reporting can be a difficult and time-consuming process. It is crucial to create methods that expedite the procedure while still adhering to regulatory criteria in order to ensure correct reporting and compliance. You can make sure your company stays in compliance with legal obligations while maximizing your financial operations by comprehending the subtleties of statutory reporting and putting into place practical solutions. For example, in multinational finance departments, most of the statutory reporting work is completed before tax returns are prepared, and much of that statutory information can be re-purposed to avoid duplication.

This service supports payday filing, a recurring statutory obligation in payroll processing. If you’re wondering, “Is Thomson Reuters AMERS (legacy) Statutory Reporting down?”, or need to know itscurrent status, we’ve got you covered. Our platform tracks everyreported outage, performance issue, and maintenance window to ensureyou’re informed. Whether Thomson Reuters AMERS (legacy) Statutory Reporting is experiencing a Cash Flow Statement problem now orhas recently resolved one, our detailed history keeps you updated.

You must be logged in to post a comment.

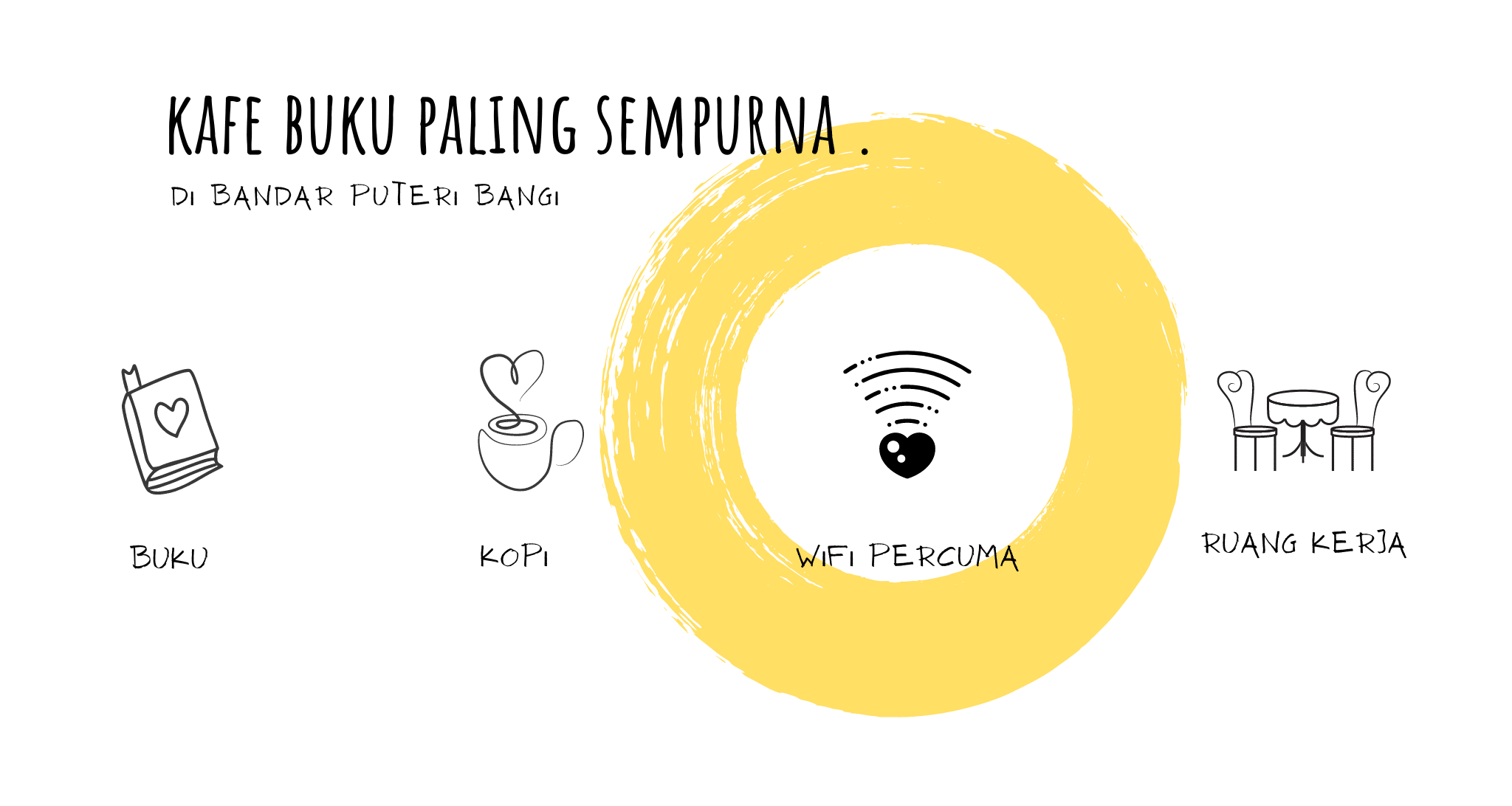

Co-working space l Seminar l Kelas l Wacana l dan lain-lain ?