Until the payment is made, the amount owed is recorded as Trade Payables. This helps the business manage routine expenses without immediate cash outflow. Managing cash flow becomes smoother when businesses track due payments, maintain enough cash for daily needs, and manage expenses effectively to support uninterrupted operations.

Use Ramp Bill Pay independently, or connect it Balancing off Accounts with Ramp’s corporate card programs, expense tools, and procurement platform for complete spend visibility. Up to 95% of companies report better payables oversight after switching to Ramp2. Ensuring the validity of invoices is essential to avoid being overcharged or getting caught up in invoice fraud. Matching invoices with relevant documents such as purchase orders, receiving reports and inspection slips can help prevent these issues.

Effective management of AP and TP leads to better financial control, improved vendor relationships, and long-term business growth. For example, purchasing raw materials for manufacturing would be classified as a trade payable, while paying for office space or a business loan would fall under accounts payable. Understanding this distinction helps finance teams allocate resources more effectively and optimise cash flow. To learn more about managing overall payables, explore our detailed guide on accounts payable. Trade payables play a crucial role in business operations, especially for finance teams managing complex supply chains in Singapore. They provide businesses with the flexibility to purchase goods and services on credit, helping to preserve cash flow and maintain financial stability.

That’s a fast route https://famyananta.com/solved-problem-13-2a-cash-dividends-treasury-stock/ to supply chain issues, credit report issues and strained supplier relationships. However, the poor management of these payments can damage the supplier relationship and lead to fraud risk. These serve an important purpose in accounting as they help to know the cost of doing business. As a result, it helps businesses to predict their profit margin and helps them to do changes to increase it.

If you manage your trade payables with efficiency and clear intentions, it might be simpler to achieve that sweet spot between what you have in terms of resources as a company and what you owe. For example, a trade payable vs accounts payable manufacturer might have trade payables for raw materials or components that are used in the production process. The process begins when your business receives an invoice for goods or services purchased on credit. For example, the finance team might receive a $500 invoice for monthly bookkeeping services, due in 30 days. Trade payables are the amounts a business owes to its suppliers for goods or services bought on credit.

You must be logged in to post a comment.

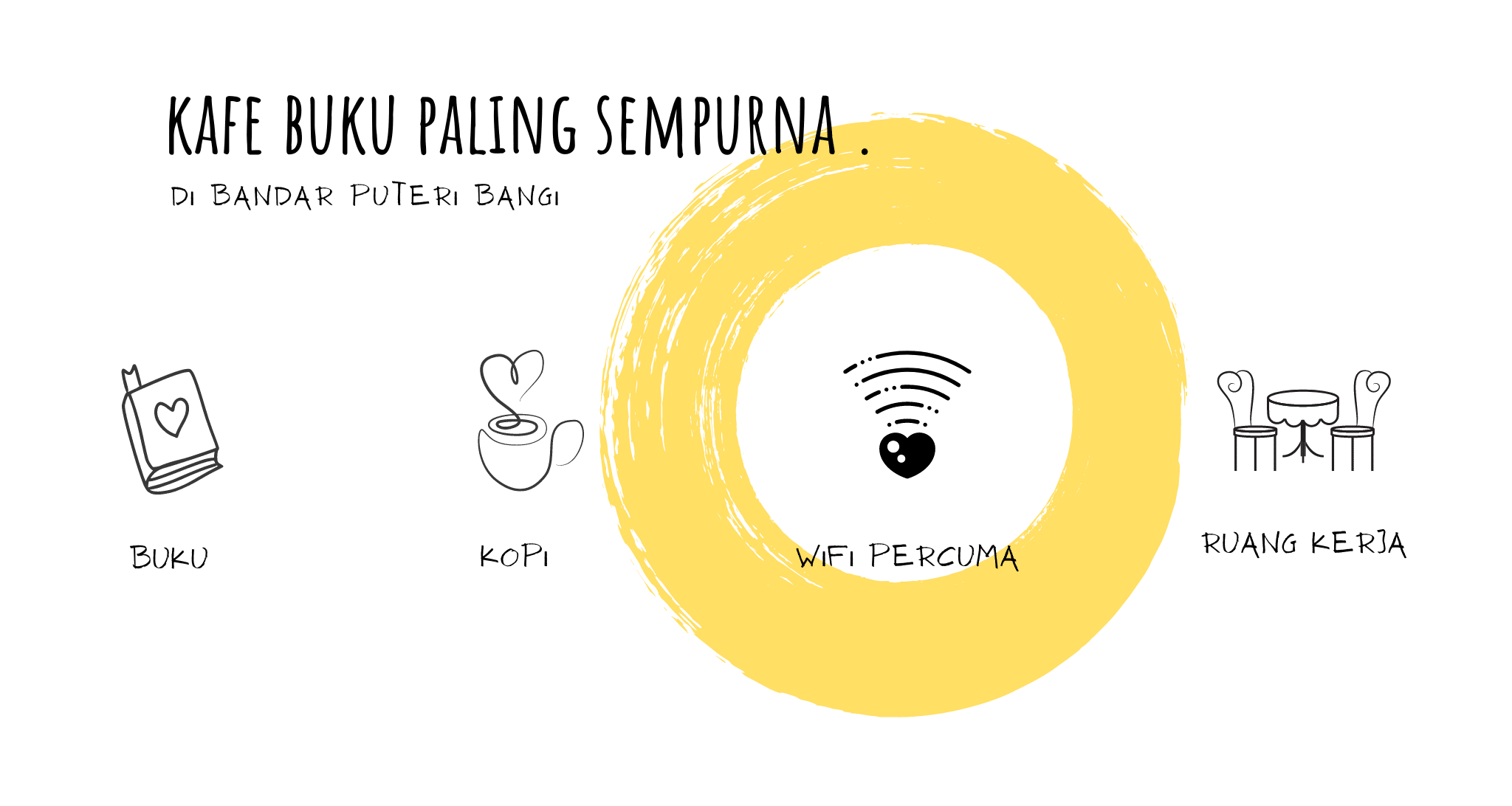

Co-working space l Seminar l Kelas l Wacana l dan lain-lain ?