The tax is computed on the selling price (not your cost) of the taxable goods, rental, lease or service. Also, if the ownership or structure of the business changes (for example, if a sole proprietorship becomes a partnership or corporation), a new permit is required. You are required to register before you start your business. The Taxpayer Portal enables advanced payment scheduling and allows users to check compliance across all tax accounts. Within 30 days after payment of the tax, the Tax Administrator may, on request, redetermine the retail dollar value after affording the taxpayer reasonable opportunity to be heard. In the case of a casual sale of a motor vehicle, the tax imposed cannot be less than the product obtained by multiplying the tax rate by the retail dollar value.

Information related to sales and use tax in the state of Georgia. Businesses shipping goods into Utah can look up their customer’s tax rate by address or zip code at tap.utah.gov. If you have or are required to have a Utah Sales and Use Tax License, you must report and pay the use tax on your Utah Sales and Use Tax Return (Form TC-62S or Form TC-62M). For example, charges for labor to repair, renovate or clean tangible personal property are taxable.

Modification of exemption for certain sales of rare or antique coins, gold or silver bullion, and gold or silver legal tender Under audit, the state can collect the tax from either the seller or the purchaser. The tax is generally imposed on the privilege of using or consuming the products or services purchased. In Consumer Tax states, the tax is imposed on the buyer with responsibility for collection by the seller. Under audit, the state can only collect the tax from the seller.

Every person, firm or organization engaged in the business of making retail sales in this state is required to obtain a permit. Complementing the sales tax, a use tax is imposed at 7% on the storage, use or consumption in this state of tangible personal property We also administer a number of local sales taxes. Applies to completing a sales and use tax return (ST-3) on GTC for sales that occur on or after April 1, 2018.

If taxes are underpaid, you will be assessed the additional amount due. If you receive a calculation worksheet for a currently filed return, the correction should be made on the worksheet provided and returned to our office at the address indicated. Sales, use, and gross receipts tax returns may be amended to report additional tax due or to request a refund of tax paid in error. You should apply for a permit 30 days prior to opening for business.

You can continue to the PDF form below, or go to TAP to register and begin filing electronically now—no need to wait until the deadline! If you do not include the correct schedule(s), your business registration will be delayed. It does not contain all tax and motor vehicle laws or rules. Sales tax is a “transaction tax”, meaning it is a sales and use tax tax on the SALE of the vehicle, not the vehicle itself. Utah also accepts the multi-state Uniform Sales & Use Tax Exemption/Resale Certificate.

Who is required to obtain a sales and use tax registration certificate in Georgia? On this page, find information and forms related to sales and use taxes. Attend one of our workshops for more complete information on sales and use taxes in Utah. If you are purchasing a business, you could be held liable for previous sales and special fuel taxes the business may owe if you do not meet the requirements above.

If Utah sales and use tax is due on a transaction and the seller does not collect the tax the purchaser must pay use tax on the purchase price of the transaction. Every sales tax license holder must file timely returns with the Tax Commission even if sales tax was not collected for that period. If you have a North Dakota Sales Tax Permit, please use ND TAP to submit any sales and use tax you owe when you file your return. To register to collect sales tax in multiple states, use the Streamline Sales Tax Registration. To register to collect and remit applicable sales and use tax in North Dakota ONLY, complete the online application on ND TAP.

A remote seller is someone who makes retail sales of tangible personal property, services, or specified digital products into North Dakota, but does not have a physical presence in the state. If you purchase an existing business, you must apply for a new sales tax permit, as permits are not transferable. The sales tax is paid by the purchaser and collected by the seller. Although the list of examples of the services subject to sales tax are not intended to be all inclusive, it should be used as a guide to answer your questions regarding the application of sales tax to these services.

In addition, tangible personal property not originally purchased for use in North Dakota is subject to use tax plus applicable local taxes based on its fair market value at the time it was brought into the state. Information about local jurisdiction service fee rates can be found in the DR 1002 publication. Corporations or financial institutions including International Banking Facilities shall not be exempt from the minimum tax payable even if the business or source income is exempt under other provisions of the DC Code.

Use Tax is owed by New Jersey residents and businesses that buy products out of state, online, or via the mail, and then bring the products to New Jersey or have them shipped here for their use. When you buy a taxable item or service in New Jersey, the seller collects New Jersey Sales Tax from you on the purchase.

Legislation modified the exemption set forth in Conn. Extension of exemption for certain Aircraft joint ventures To obtain a Certificate of Authority, you must complete Form DTF-17, Application for Registration as a Sales Tax Vendor, for your business and send it to the address listed in the instructions for that form, at least 20 days before you begin operating your business. Most personal property (for example, alcohol, furniture, electronics, etc) The purchaser remits this tax directly to the taxing jurisdiction. Use tax applies to purchases made outside the taxing jurisdiction but used within the state.

The sales taxes collected by a merchant are not part of the merchant's sales and are not part of the merchant's expenses. Instead, the merchant is merely an agent of the state and will record the sales taxes collected in a current liability account such as Sales Taxes Payable.

This law became effective on June 21, 2018, when the United States Supreme Court ruled in South Dakota v. Wayfair that sellers can be required to collect sales taxes in states where the sellers do not have physical presence. Complete a Rhode Island sales and use tax resale certificate bearing your sales tax permit number, and give it to the vendor from whom you make a purchase of goods or services which you intend to resell. These rules do not apply to casual sales or isolated sales, which are infrequent sales of a nonrecurring nature made by a person not engaged in the business of selling tangible personal property or taxable services.

You may also register by submitting the completed BAR form to or Some casual sales, such as those made between members of the immediate family, are exempt. Where the sales price is greater than the retail dollar value, the sales price is used.

If selected for an audit, a sales tax auditor will work with you to determine how the audit will be the least disruptive to your business. If you apply for the Montana sales tax exemption, complete the Certificate of Purchase – Exempt Sales to a Person from Montana form. Cities and counties may levy sales and use taxes, as well as special taxes such as lodging taxes, lodging and restaurant taxes, and motor vehicle rental taxes. Beginning January 1, 2026, retailers may no longer retain the state sales tax service fee.

Since the tax is not required to be passed on to the purchaser, it is not required to be separately stated on the invoice. This determines who is primarily liable for the payment of the tax. Sales tax is generally added to the sales price and is charged to the purchaser. For additional information on use tax and reporting and payment options, visit Use Tax for Individuals or Use Tax for Businesses. Out-of-state businesses and Internet vendors often falsely advertise that they sell taxable items “tax free”. Watercraft owners are required to register their vessels with North Dakota Game & Fish before operation.

You must be logged in to post a comment.

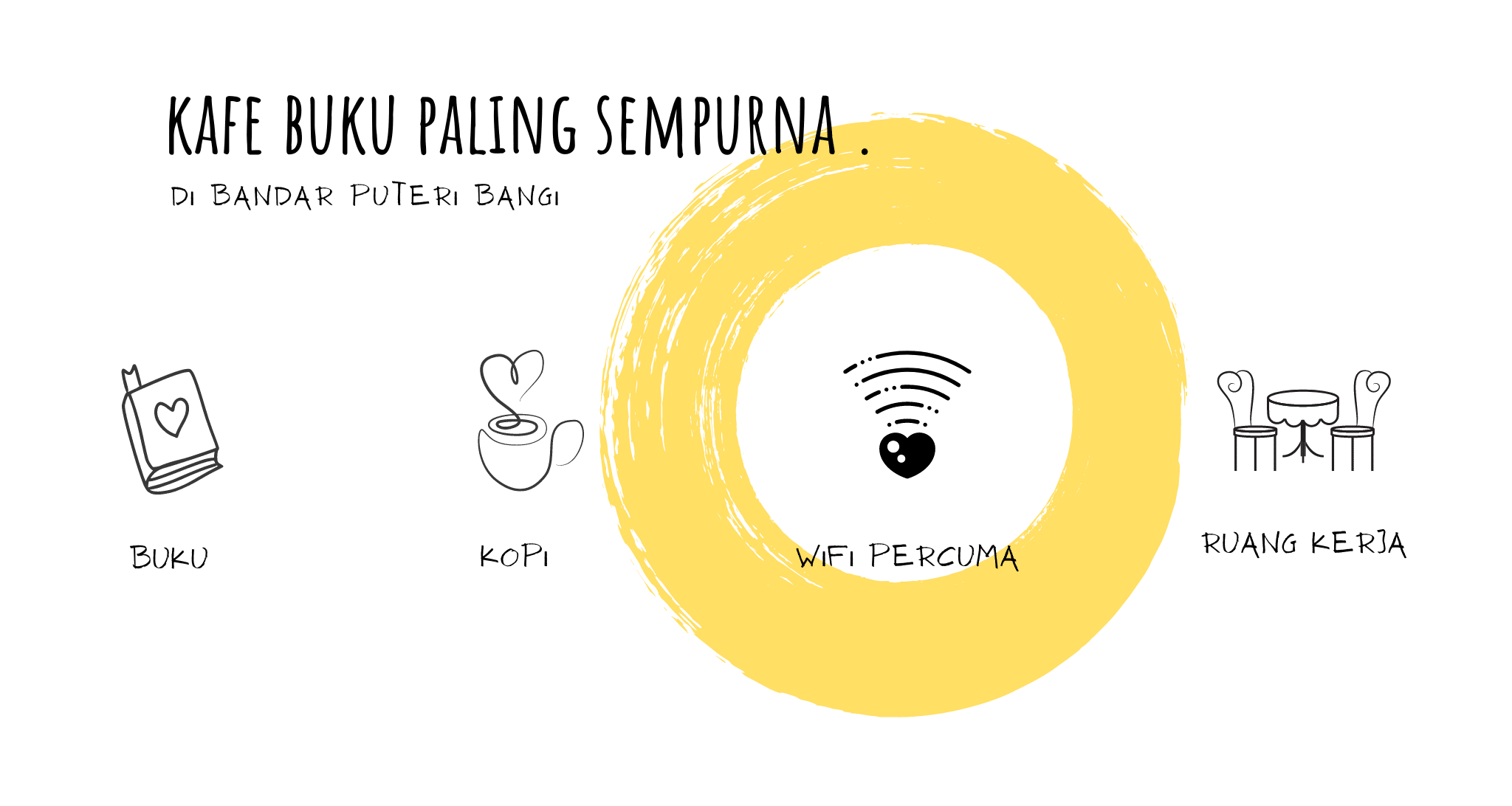

Co-working space l Seminar l Kelas l Wacana l dan lain-lain ?